capital gains tax rate canada

In Canada capital gains from stocks also provide Canadians with tax advantages. Although the concept of.

How Are Capital Gains Taxed Tax Policy Center

As of 2022 it stands at 50.

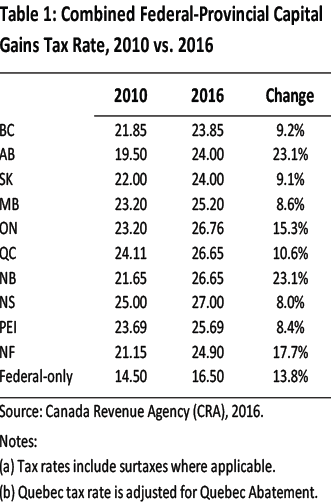

. The highest income group in Ontario is subject to a tax rate of 2676 percent on their capital gains. Lets say you sold BMO which I would never do its one of my favourite Canadian dividend stocks for a profit of. Rewarding resident Canadian business owners for their contributions to the Canadian economy the CGE allows for the exemption from tax the first 913630 gain in.

The capital gains tax is the same for everyone in Canada currently 50. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. So if you make 1000 in capital gains on an investment you will pay capital gains tax on.

So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total capital. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. The capital gains tax is the same for everyone in Canada currently 50.

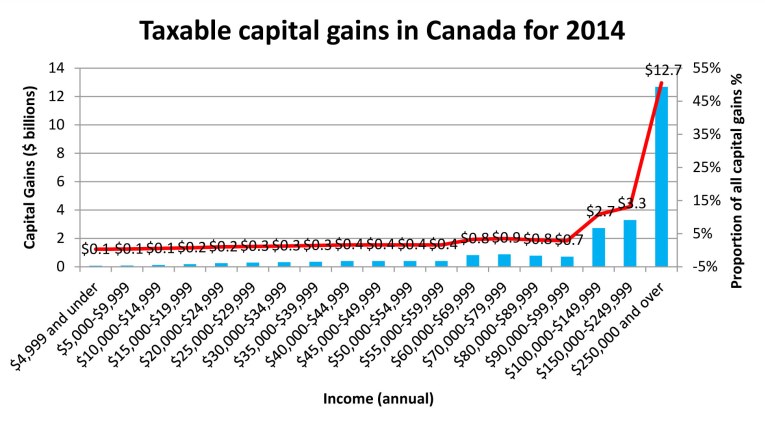

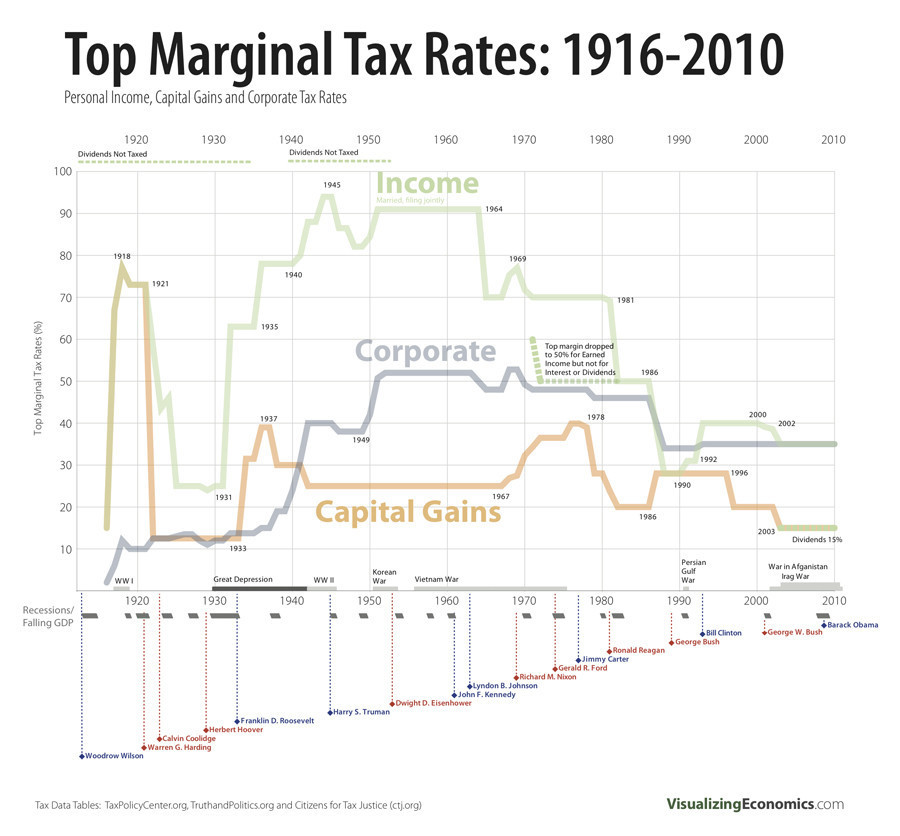

The inclusion rate has varied over time see graph below. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income.

In Canada capital gains are taxed at 50 of your marginal rate. And the tax rate depends on your income. The inclusion rate has varied over time see graph below.

As of 2022 it stands at 50. A in the case of Canada the taxes imposed by the Government of Canada. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

In other words if you sell an investment at a higher price than you paid realized. Investors pay Canadian capital gains tax on 50 of the capital gain amount. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

This results in a capital gains tax liability of 53520 which must be paid in the event. The General Corporate Federal Tax rate also known as the higher tax rate is 38 with a 10 federal tax abatement and a 13 general tax reduction leaving a total of 15 net tax for. On the flip side an.

For example if you make a 1000 capital gain you are taxed on only 50 of the gain and that is with your. Capital gains tax in Canada In Canada 50 of the value of any capital gains is taxable. Following the remaining 100000 earnings of business profit from Company X will be subjected to a tax rate of 265.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. For a Canadian who falls in a 33 marginal. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than.

The inclusion rate is the percentage of your gains that are subject to tax. This results in a total tax liability on the business income of. Understanding The Three Types Of Income Four Pillar Freedom Market Weekly Update 4 26.

The inclusion rate for personal. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. When looking at capital gains taxes in Canada the most popular question is How much is the capital gain tax According to the Canadian government 50 of all capital gains are taxable.

The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

Ten Reasons To Reform The Tax Code Reason 8 Ten Reasons To Reform The Tax Code Reason 8 United States Joint Economic Committee

Too Many Analyses Misrepresent Capital Gains Income And Taxes Fraser Institute

Capital Gains Tax Canada 2022 Short Term Long Term Gains Wealthsimple

Why Do People Buy Us Stocks And London Stocks When Both Countries Tax Capital Gains By A Lot And Dividends By A Lot Why Don T People Invest In Other Non Western Stock Exchanges

Canada Capital Gains Tax Calculator 2022

Crypto Capital Gains And Tax Rates 2022

Opinion Biden S Capital Gains Tax Hike Is His Fourth Hit On The Rich Marketwatch

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

Personal Income Taxes And The Capital Gains Tax Fraser Institute

Top Marginal Income Corporate Tax Rates 1916 2010 Chart Huffpost Impact

How Capital Gains Tax Works In Canada Nerdwallet

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Are Tax Rates Different Based On Whether Your Income Is From Employment Vs Capital Gain R Personalfinancecanada

Northern Trust Wealth Management Asset Management Asset Servicing